IRYS Jumps 76% — Can Bulls Hold This Key Support Zone?

Key Takeaways

What is the price outlook for IRYS?

With limited historical data, IRYS shows a short-term bullish trend following its recent launch. However, caution is warranted until more price action develops.

What did on-chain sleuths uncover?

Investigators claim that roughly 20% of the total airdrop supply ended up in wallets controlled by a single entity. These concerns have not been disproven and remain a potential risk factor.

Irys (IRYS) has surged 76.2% in the past 24 hours at press time. The mainnet, which launched on November 25, appears to have captured early investor confidence.

Promoted as the data backbone of the AI economy, the network offers high throughput and scalable storage designed to support AI-level workloads.

Whether the young chain can deliver on these promises remains uncertain. For now, the IRYS token maintains a short-term bullish outlook, based on the limited technical analysis available.

Because the token is newly launched, price projections are restricted to short-term movements. Market sentiment also received a boost from a Bitget trading competition featuring 740,000 IRYS in rewards.

However, on-chain analysis has raised red flags. One crypto sleuth identified clusters of wallets holding unusually large amounts of IRYS, suggesting potential coordinated sell pressure. Another investigator noted that 20% of the airdropped tokens were claimed by a single entity.

Such concentration could lead to future sell-offs, potentially capping price appreciation. For now, technical analysis can offer only short-term insights due to the limited trading history.

Lineup Games Postpones Release of LINEUP Token

Lineup Games Delays LINEUP Token Launch to Q1 2026

Lineup Games has postponed the launch of its LINEUP token, originally scheduled for November 30, 2025, to the first quarter of 2026.

The LINEUP token is a core part of Lineup Games’ ecosystem, connecting in-game activity across titles such as Gold Striker and Striker League. The delay is expected to impact user engagement and motivation, particularly for players anticipating early token access.

Strategic Delay to Strengthen the Ecosystem

The developer described the postponement as a “strategic opportunity” to enhance token accessibility, ensure smoother exchange integrations, and support the long-term growth of its gaming ecosystem.

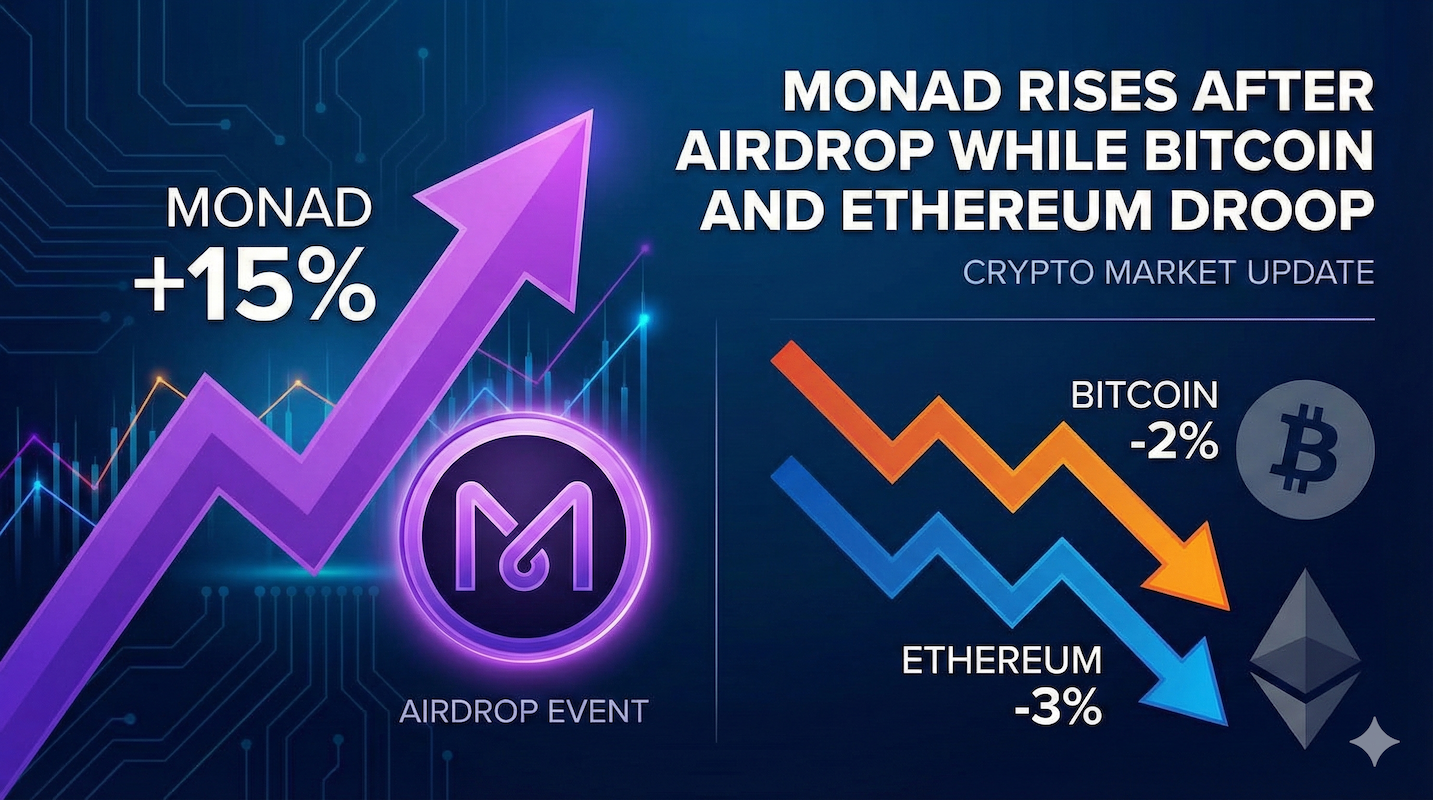

Monad Surges Following Airdrop as Bitcoin and Ethereum Slip

The price of Monad’s native cryptocurrency climbed on Tuesday following a highly anticipated airdrop that initially fell short of some speculators’ expectations.

The token, which serves both to pay transaction fees and to secure the layer-1 network via staking, recently traded at $0.042—up 19% from the previous day, according to CoinGecko.

MON’s latest price represents a 68% jump from its initial $0.025 valuation on Monday, which was set during a recent public sale. Earlier on Tuesday, the token even touched $0.045.

Aster Completes S3 Buyback, Plans Burn, Airdrops & S4 Launch

Aster has officially announced the completion of its Season 3 (S3) buyback program.

According to the update posted on X on November 20, 2025, the team successfully repurchased 55,720,650 $ASTER tokens in the S3 phase. Combined with previous seasons, the total number of tokens bought back has now reached 155,720,656 $ASTER.

Half of all tokens repurchased during Season 3 are scheduled to be burned on December 5, 2025, further reducing circulating supply.

Aster also confirmed that Season 4 will begin on December 10, 2025, with 60–90% of platform-generated fees allocated toward continuous buybacks, reinforcing its long-term commitment to token value management.

The primary goal of the S3 buybacks was to support the token’s market value by reducing supply and building investor confidence. All transactions related to the buyback initiative remain fully verifiable on-chain.

Following the announcement, the price of $ASTER saw a positive reaction. As of press time, the token is trading at $1.27, up 0.4% in the past hour according to CoinGecko data.

Bitget Announces Phase 28 of Onchain Challenge Featuring a 120,000 BGB Airdrop Pool

Bitget, the world’s largest Universal Exchange (UEX), has announced the launch of Phase 28 of its Onchain Challenge. This round features a total reward pool of 120,000 BGB, offering both credit-based rewards and leaderboard incentives for eligible participants. The campaign runs from November 20 at 12:00 AM to November 26 at 11:59 PM (UTC+8).

Participants who register through the official campaign page can earn credits by completing daily Onchain spot buy orders. Credit accumulation begins with a minimum transaction of 50 USDT, with larger trade volumes awarding progressively more credits. There is no daily cap on credit earnings, giving users greater opportunities to qualify for rewards.

The 120,000 BGB reward pool is divided into two activities:

Activity 1: Users who reach the minimum required credit threshold—announced by Bitget on social media after the event—will share 60,000 BGB based on their proportional credit contribution.

Activity 2: The top 828 traders by total trading volume (buys + sells) will receive direct BGB rewards ranging from 50 to 1,500 BGB, depending on their final leaderboard position.

Only orders placed after successful registration will count toward the promotion. Credits are calculated according to the actual execution date of Onchain buy orders and reset daily. New users who qualify for Bitget’s new-user bonus will be excluded from the existing-user reward pool to maintain fairness.

All rewards will be distributed within five working days after the campaign concludes and can be viewed in users’ spot accounts. API trades, sub-accounts, institutional participants, and market makers are excluded from this promotion. Bitget will disqualify any participants found engaging in fraudulent, manipulative, or automated trading behavior.

Aster Unveils Stage 4 Airdrop and $10M Trading Competition to Drive Ecosystem Expansion

Aster, a decentralized perpetual exchange, is entering a period of accelerated growth. After the strong performance of Stage 3, the platform has launched the Stage 4 “Harvest” airdrop program and will kick off the “Double Harvest” trading competition on November 17, featuring a total reward pool of $10 million. At the same time, Aster continues expanding its early-asset incubation product, Rocket Launch, broadening the pipeline of new token initiatives.

These incentive programs operate simultaneously, allowing users to earn multiple layers of rewards from the same trading activity, significantly boosting platform participation and market depth.

The Stage 4 airdrop pool represents 1.5% of the total $ASTER supply (around 120 million $ASTER) and is distributed evenly across six weekly Epochs. Running alongside it, the $10 million “Double Harvest” competition includes five independent weekly leaderboards, enabling users to receive both airdrop and competition rewards for identical trading behavior.

Rocket Launch Gains Momentum as a Core Growth Driver

Beyond the airdrop and trading competition, Aster Rocket Launch continues to gain traction. Designed to help early-stage projects accelerate by increasing liquidity and trading volume, the product has seen rapid adoption. In its first month, the platform launched five new token campaigns with a combined reward pool exceeding $3 million.

This growth reflects rising market demand for early-stage liquidity and token-launch mechanisms. Rocket Launch is quickly becoming the entry point for new projects seeking initial liquidity and user acquisition, while simultaneously becoming a major catalyst for Aster’s ecosystem expansion.

Infrastructure Expansion: Developing an On-Chain Order-Book Layer-1

In parallel with short-term incentive programs, Aster is fast-tracking its long-term infrastructure roadmap. During a recent AMA, the team confirmed active development of a high-performance Layer-1 blockchain featuring an on-chain order book with optional privacy. The chain is designed to execute order placement, matching, and cancellation directly at the protocol layer.

The goal is to deliver a CEX-like trading experience fully on-chain, combining transparency, self-custody, privacy, and high-speed execution. Internal tests and an initial public testnet are scheduled for late 2025, with mainnet launch targeted for Q1 2026.

Over the next two quarters, Aster also plans to expand the utility of $ASTER, including staking, governance, fee discounts, VIP tier benefits, airdrop qualification, and yield-enhancement integrations with DeFi protocols. The platform has added gold and index perpetuals and will further broaden its lineup of commodity- and equity-related instruments. Integrations with Trust Wallet, Safepal, Math Wallet, Lista DAO, and other ecosystem partners will also deepen.

Growing Global Presence and Industry Influence

Aster’s international profile continues to rise. CEO Leonard recently spoke at Binance Campus APAC in Korea, outlining the platform’s infrastructure vision to regional leaders. Aster is also scheduled to participate in Binance Blockchain Week in Dubai this December, reinforcing its global expansion strategy.

With multi-track incentives, a rapidly growing product ecosystem, and continued investment in core infrastructure, Aster is charting a steeper growth trajectory heading into 2026. The platform is advancing toward a hybrid model built on “on-chain order-book infrastructure + incentive-driven growth,” positioning itself to capture a larger share of the decentralized trading market and build the next generation of global on-chain trading infrastructure.

Monad Blockchain Launches With 100B Token Supply and Airdrop Program

The layer-1 Monad blockchain officially launched on Monday, accompanied by an airdrop of its native token, MON.

According to project documentation, MON has a total supply of 100 billion tokens, with 10.8% currently unlocked and in circulation. That circulating amount is split into two parts:

7.5% was released last week through a public sale on Coinbase’s Token Platform, priced at $0.025 per token.

3.3% is unlocking as part of the airdrop.

The Monad team describes the network as a high-performance blockchain designed to support a wide range of fast-growing sectors, including DeFi, payments and stablecoins, and institutional high-frequency finance use cases. The chain is also EVM-compatible, aiming to help scale the Ethereum Virtual Machine and support its next stage of development.

The remainder of the MON token supply is allocated as follows:

27% to the Monad team

19.7% to investors

4% to the Labs Treasury

38.5% for ecosystem development

Some community members on X criticized the distribution, arguing that the team allocation is higher than typical industry standards.

“Monad mainnet’s public launch marks a major step toward making high-performance blockchain infrastructure accessible to everyone. Developers shouldn’t have to choose between speed, security, and usability,” said Keone Hon, Monad co-founder, in a statement shared with CoinDesk.

“With Monad, we’ve worked to deliver all three—without requiring builders to abandon the tools and languages they already know. We’re excited to empower a new wave of applications and move blockchain technology closer to mainstream and institutional adoption.”